Since many days, it has been talking more and more about Bitcoin Halving. Finally it countdown now, going to be halving at 2020.

For everyone that has been following Bitcoin latterly, there’s been tons of state a “Bitcoin Halving” that's coming back “really soon”.

So, what's this Bitcoin halving? however can it impact the crypto market and what will this mean for the coin’s future value? Has this happened before? And if thus, what were the consequences? These square measure a couple of of the queries that i will be able to try and answer during this article.

Before we tend to do thus, however, we want to require a step back and canopy some basic notions regarding Bitcoin and therefore the approach new coins square measure issued.

Since its creation in 2009, Bitcoin acts as a far better thanks to exchange worth. sure rules had to be established so as for it to be simpler and advantageous than the normal strategies like act currency or bank transfers.

As a peer-to-peer currency, the Bitcoin network together manages all transactions with none central dominant authority, like a bank or financial organization.

Apart of that, Bitcoin has, by design, a restricted provide of twenty one million Bitcoins. New Bitcoin is generated daily by a method referred to as mining, that is calculable to conclude by the year 2140, once the last coin are deep-mined.

This controlled unharness of recent coins is impeccable for the coin’s worth. In short, this suggests that after we tend to reach the provision cap there'll be no chance to mine new Bitcoin. As a result, individuals expect that each the worth and inadequacy of the coin can increase.

Gold is one trade goods that follows the same notion. we tend to do have a general plan of its restricted provide and therefore the demand is high, that has inflated the value of the dear metal over time.

Having same that, let’s take a glance at one basic mortal between the strategy of mining gold compared to mining Bitcoin.

Bitcoin isn't well-mined with shovels in classified mining sites.

No, mining cryptocurrency may be a fully digitalized method.

Bitcoin mining needs powerful computers, conjointly referred to as nodes, to finish procedure issues which permit them to chain along “blocks” of transactions within the Blockchain.

By doing this, miners square measure rewarded with recently created Bitcoins and group action fees. And because the network’s quality grows and additional folks use Bitcoin, rewards from group action fees increase even additional.

There square measure three things that occur through mining Bitcoin:

This is pretty obvious. so as to eventually reach the cap of twenty one million Bitcoin, miners that complete all transactions of a block receive recently well-mined Bitcoins. this implies that there's a mean of 1800 new Bitcoins created daily as, currently, there square measure close to a hundred and forty four blocks presently well-mined per day (144*12.5=1800).

A group action is just secure and complete once it's enclosed in an exceedingly block and embedded within the Blockchain. Miners make sure transactions so as to stop double-spending of an equivalent Bitcoin. Simply put, it eliminates the danger of a group action reversal and double-spending.

Miners create the Bitcoin network safer by creating it harder to attack. The additional miners, the safer the network becomes.

Bitcoin is that the leading cryptocurrency with the foremost miners, creating its Blockchain the foremost secure at this moment. so as to reverse a group action, the assailant should have quite fifty one of the network’s combined hash power.

All in all, mining is crucial to Bitcoin’s existence; as long as Bitcoin and its Blockchain exists, there'll be miners and the other way around.

The evolution of Bitcoin mining over time

The first 2 those that well-mined Bitcoin were the cryptocurrency’s creator Satoshi Nakamoto and early adoptive parent Hal Finney. the newest is even reported to be Satoshi Nakamoto himself.

Here’s a cool fact: Bitcoin has tortuous rules for mining. The additional mining power the network has, the more durable it's to substantiate transactions. this implies that the issue of the mathematical issues that require to be resolved so as to issue new Bitcoins is adjusting mechanically because the procedure power of the network will increase.

As such, it absolutely was necessary for miners to enhance hardware solutions so as to stay profitable.

The first mining upgrades happened throughout 2011. CPUs couldn’t maintain with mining demands therefore miners started victimisation their GPUs (Graphics process Units). the most recent has additional process power and might, thus, solve additional advanced mathematical issues.

Then, around 2013, the ASIC (application-specific integrated circuit) miners were introduced to the scene and have since then become the mining customary hardware. to place things in perspective, one ASIC jack has the ability of around 700 GPUs. this is often why, to the present day, the ASIC dominates the mining market.

Bear with Pine Tree State as this is often all relevant to the halving of mining rewards.

Satoshi Nakamoto created Bitcoin with the intention of it being and remaining valuable through time.

As such, a group of ground rules were coded among the Blockchain to render the cryptocurrency immune to inflation.

In the case of order currencies, government banks square measure able to print extra money annually and thus decreasing its worth. By doing this, they enter AN inflationary economic model wherever they incentivize disbursement currently instead of later. this technique is steered towards high leverage practices like debts, loans, and credit.

The inflationary model is prejudicious, particularly within the long run. the worth of people’s savings reduces over time and, by the time they retire, their long financials square measure price solely a fraction of their original worth.

Let’s take the shopping for power of one hundred North American nation greenbacks as AN example. thanks to inflation, that quantity of cash in 1970 would have more or less a similar getting power of $700 nowadays. that's quite distinction in fifty years.

This is the explanation behind the Bitcoin halving principle. Satoshi Nakamoto wished the worth of Bitcoin to extend, rather than decrease, over time.

Bitcoin Halving – what's it and the way will it work?

Satoshi Nakamoto introduced the halving mechanism, that primarily stands for the dynamical of miners’ rewards by 0.5, more or less once each four years. whenever 210.000 blocks square measure mined , the reward decreases and a replacement “reward era” starts.

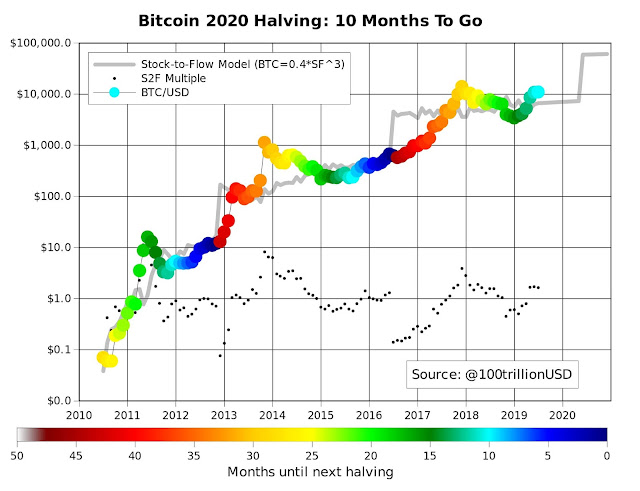

Looking back in time, there are a pair of additional halvings that already occurred, and that we square measure currently within the third reward era, wherever one mined block grants twelve.5 Bitcoins.

In a deflationary economic model, the issuing of latest currency lessens over time, which implies that it'll be price additional soon. Taking into thought the inadequacy, mining problem and therefore the controlled provide of Bitcoin, what you get could be a foolproof model of a artifact that will increase in worth over time.

“If the coinage doesn't increase as quick as demand, the other of inflation can occur, and early holders of the currency can see its worth increase. In AN economy, cash must be distributed and made somehow, and a continuing rate appears to be the most effective formula.”

There are criticisms of this model within the past. Wouldn’t this produce another drawback, particularly aggregation Bitcoin and ne'er truly defrayment it? This question usually comes up:

“Why would anyone need to pay Bitcoin, if they're bound that it'll be price a lot of within the future?”

The answer is kind of easy, really. albeit deflation discourages defrayment, you'll ne'er eliminate the necessity for it. Basic wants don't seem to be one thing we are able to forgot. Commodities and luxuries become a temporal arrangement preference rather than a synthetic would like. folks get to settle on if they require to pay currently or later.

As such, one will use Bitcoin each as a store valuable and as a currency. Only, rather than its price decreasing and stagnating over time, as is that the case with government-based currencies, Bitcoin will increase its price over time, resulting in enlarged thought adoption.

The first Bitcoin halving occurred on the twenty seventh November 2012.

Block 210000 was resolved by a Radeon 5800 GPU, one amongst the foremost in style GPUs at that point used for mining. The graphics card was later oversubscribed at a big markup to Chaang Noi, associate early Bitcoin capitalist.

In the following year, market costs of the leading cryptocurrency skyrocketed. a brand new peak worth was reached concerning one year once the halving happened. the worth of Bitcoin enlarged from one2$ to a brand new high of 1.120$. the worth corrected in 2014 and an extended pessimistic market put in some doubt within the capitalist minds. Market sentiment was at a coffee purpose sure as shooting, as Bitcoin’s worth fell within the 300$ vary, retracing by over seventieth.

And then, the second halving happened. it had been this halving of July 2016 that opened the trail for the crazy 2017 Battle of Bull Run of Bitcoin wherever we have a tendency to saw costs reach new highs another time. From 657$ at the instant of the second halving to a still undefeated record of nineteen.780$ by December 2017.

Based on the higher than, and by any analyzing the consequences of the previous halvings on the coin’s value, we will see that the worth increase was ne'er immediate. Instead, what happens when every halving is somewhat of Associate in Nursing “awareness” timeframe for investors and speculators to soak up the concept of raised inadequacy.

In each occurrences, the halving has been a precursor of unbelievable bull runs and tremendous gains in worth versus the U.S. dollar.

All of this brings U.S. to might 2020.

In but a year, the third reward era is are ending and therefore the reward for mining new Bitcoins are cut in [*fr1] (6.25 coins per block).

For miners, this might sound harmful, because the reward barely covers their dynamic electricity prices. Some even say mining is nothing however a “dead-end” and can before long be a factor of the past.

But take into account this: within the 1st halving cycles, there wasn’t enough relevant knowledge for miners to fall back on and have any quite expectation concerning a rise within the worth of Bitcoin. they'd to accept theoretical speculation on scarceness and a general belief within the cryptocurrency’s viability.

As a consequence of the reward halving, there's a high expectation for a rise within the coin’s worth. it's currently apparent that the halving cycles lead to a replacement incentive to shop for Bitcoin on the market, driving the costs up.

If the market behaves because it has within the past we are able to definitely be excited of what 2020 and 2021 will awaken the table.

Bitcoin may be a cryptocurrency that, by design, will increase in price over time. By secret writing the halving mechanism into the network, inflation remains under control and scarceness will increase over time.

Hopefully, the Bitcoin halving of 2020 can act as another milestone within the maturity of the cryptocurrency market. At this moment, there ar clear signs of recovery.

And although we tend to cannot predict however the halving can have an effect on Bitcoin’s worth within the end of the day, we are able to completely predict that the trend will continue throughout 2020 and when the halving.

For everyone that has been following Bitcoin latterly, there’s been tons of state a “Bitcoin Halving” that's coming back “really soon”.

So, what's this Bitcoin halving? however can it impact the crypto market and what will this mean for the coin’s future value? Has this happened before? And if thus, what were the consequences? These square measure a couple of of the queries that i will be able to try and answer during this article.

Before we tend to do thus, however, we want to require a step back and canopy some basic notions regarding Bitcoin and therefore the approach new coins square measure issued.

Understanding Bitcoin

As a peer-to-peer currency, the Bitcoin network together manages all transactions with none central dominant authority, like a bank or financial organization.

Apart of that, Bitcoin has, by design, a restricted provide of twenty one million Bitcoins. New Bitcoin is generated daily by a method referred to as mining, that is calculable to conclude by the year 2140, once the last coin are deep-mined.

This controlled unharness of recent coins is impeccable for the coin’s worth. In short, this suggests that after we tend to reach the provision cap there'll be no chance to mine new Bitcoin. As a result, individuals expect that each the worth and inadequacy of the coin can increase.

Does this ring any bells?

Gold is one trade goods that follows the same notion. we tend to do have a general plan of its restricted provide and therefore the demand is high, that has inflated the value of the dear metal over time.

Having same that, let’s take a glance at one basic mortal between the strategy of mining gold compared to mining Bitcoin.

What is Bitcoin Mining?

Bitcoin isn't well-mined with shovels in classified mining sites.

No, mining cryptocurrency may be a fully digitalized method.

Bitcoin mining needs powerful computers, conjointly referred to as nodes, to finish procedure issues which permit them to chain along “blocks” of transactions within the Blockchain.

By doing this, miners square measure rewarded with recently created Bitcoins and group action fees. And because the network’s quality grows and additional folks use Bitcoin, rewards from group action fees increase even additional.

There square measure three things that occur through mining Bitcoin:

Issuing new coins

Confirmation of transactions

Security of the network

Bitcoin is that the leading cryptocurrency with the foremost miners, creating its Blockchain the foremost secure at this moment. so as to reverse a group action, the assailant should have quite fifty one of the network’s combined hash power.

All in all, mining is crucial to Bitcoin’s existence; as long as Bitcoin and its Blockchain exists, there'll be miners and the other way around.

The evolution of Bitcoin mining over time

The first 2 those that well-mined Bitcoin were the cryptocurrency’s creator Satoshi Nakamoto and early adoptive parent Hal Finney. the newest is even reported to be Satoshi Nakamoto himself.

Here’s a cool fact: Bitcoin has tortuous rules for mining. The additional mining power the network has, the more durable it's to substantiate transactions. this implies that the issue of the mathematical issues that require to be resolved so as to issue new Bitcoins is adjusting mechanically because the procedure power of the network will increase.

As such, it absolutely was necessary for miners to enhance hardware solutions so as to stay profitable.

The first mining upgrades happened throughout 2011. CPUs couldn’t maintain with mining demands therefore miners started victimisation their GPUs (Graphics process Units). the most recent has additional process power and might, thus, solve additional advanced mathematical issues.

Then, around 2013, the ASIC (application-specific integrated circuit) miners were introduced to the scene and have since then become the mining customary hardware. to place things in perspective, one ASIC jack has the ability of around 700 GPUs. this is often why, to the present day, the ASIC dominates the mining market.

Bear with Pine Tree State as this is often all relevant to the halving of mining rewards.

The reasons behind the Bitcoin Halving

As such, a group of ground rules were coded among the Blockchain to render the cryptocurrency immune to inflation.

In the case of order currencies, government banks square measure able to print extra money annually and thus decreasing its worth. By doing this, they enter AN inflationary economic model wherever they incentivize disbursement currently instead of later. this technique is steered towards high leverage practices like debts, loans, and credit.

The inflationary model is prejudicious, particularly within the long run. the worth of people’s savings reduces over time and, by the time they retire, their long financials square measure price solely a fraction of their original worth.

Let’s take the shopping for power of one hundred North American nation greenbacks as AN example. thanks to inflation, that quantity of cash in 1970 would have more or less a similar getting power of $700 nowadays. that's quite distinction in fifty years.

This is the explanation behind the Bitcoin halving principle. Satoshi Nakamoto wished the worth of Bitcoin to extend, rather than decrease, over time.

So however will this model work?

Satoshi Nakamoto introduced the halving mechanism, that primarily stands for the dynamical of miners’ rewards by 0.5, more or less once each four years. whenever 210.000 blocks square measure mined , the reward decreases and a replacement “reward era” starts.

Looking back in time, there are a pair of additional halvings that already occurred, and that we square measure currently within the third reward era, wherever one mined block grants twelve.5 Bitcoins.

Bitcoin fighting inflation

Satoshi Nakamoto explained the concept behind the halving:

“If the coinage doesn't increase as quick as demand, the other of inflation can occur, and early holders of the currency can see its worth increase. In AN economy, cash must be distributed and made somehow, and a continuing rate appears to be the most effective formula.”

There are criticisms of this model within the past. Wouldn’t this produce another drawback, particularly aggregation Bitcoin and ne'er truly defrayment it? This question usually comes up:

“Why would anyone need to pay Bitcoin, if they're bound that it'll be price a lot of within the future?”

The answer is kind of easy, really. albeit deflation discourages defrayment, you'll ne'er eliminate the necessity for it. Basic wants don't seem to be one thing we are able to forgot. Commodities and luxuries become a temporal arrangement preference rather than a synthetic would like. folks get to settle on if they require to pay currently or later.

As such, one will use Bitcoin each as a store valuable and as a currency. Only, rather than its price decreasing and stagnating over time, as is that the case with government-based currencies, Bitcoin will increase its price over time, resulting in enlarged thought adoption.

Previous Bitcoin halvings and their impact

Block 210000 was resolved by a Radeon 5800 GPU, one amongst the foremost in style GPUs at that point used for mining. The graphics card was later oversubscribed at a big markup to Chaang Noi, associate early Bitcoin capitalist.

In the following year, market costs of the leading cryptocurrency skyrocketed. a brand new peak worth was reached concerning one year once the halving happened. the worth of Bitcoin enlarged from one2$ to a brand new high of 1.120$. the worth corrected in 2014 and an extended pessimistic market put in some doubt within the capitalist minds. Market sentiment was at a coffee purpose sure as shooting, as Bitcoin’s worth fell within the 300$ vary, retracing by over seventieth.

And then, the second halving happened. it had been this halving of July 2016 that opened the trail for the crazy 2017 Battle of Bull Run of Bitcoin wherever we have a tendency to saw costs reach new highs another time. From 657$ at the instant of the second halving to a still undefeated record of nineteen.780$ by December 2017.

Based on the higher than, and by any analyzing the consequences of the previous halvings on the coin’s value, we will see that the worth increase was ne'er immediate. Instead, what happens when every halving is somewhat of Associate in Nursing “awareness” timeframe for investors and speculators to soak up the concept of raised inadequacy.

In each occurrences, the halving has been a precursor of unbelievable bull runs and tremendous gains in worth versus the U.S. dollar.

The Bitcoin Halving 2020

In but a year, the third reward era is are ending and therefore the reward for mining new Bitcoins are cut in [*fr1] (6.25 coins per block).

For miners, this might sound harmful, because the reward barely covers their dynamic electricity prices. Some even say mining is nothing however a “dead-end” and can before long be a factor of the past.

But take into account this: within the 1st halving cycles, there wasn’t enough relevant knowledge for miners to fall back on and have any quite expectation concerning a rise within the worth of Bitcoin. they'd to accept theoretical speculation on scarceness and a general belief within the cryptocurrency’s viability.

This is completely different currently.

As a consequence of the reward halving, there's a high expectation for a rise within the coin’s worth. it's currently apparent that the halving cycles lead to a replacement incentive to shop for Bitcoin on the market, driving the costs up.

If the market behaves because it has within the past we are able to definitely be excited of what 2020 and 2021 will awaken the table.

Conclusion

Here is what you must remember:

- When a Halving happens, mining rewards ar reduced to [*fr1].

- Less issued Bitcoins results in a rise in scarceness and price.

- The mining issue will increase as additional miners enter the network.

- Bitcoin halving has perpetually been a necessity for a rise within the coin’s price.

Hopefully, the Bitcoin halving of 2020 can act as another milestone within the maturity of the cryptocurrency market. At this moment, there ar clear signs of recovery.

And although we tend to cannot predict however the halving can have an effect on Bitcoin’s worth within the end of the day, we are able to completely predict that the trend will continue throughout 2020 and when the halving.